#Promotion : Do You Know That Paper Sweet (Puthareku) Is One Of The Best Sweets You Could Ever Eat?

Paper sweet, more commonly known as puthareku is predominantly made in Andhra Pradesh. Puthareku is originally prepared in Atreyapuram vi...

Read More

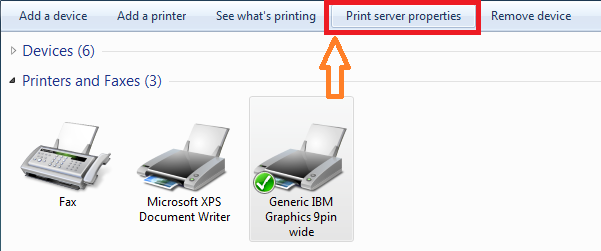

![TVS Speed 40 Plus Passbook Printer All Lights Blinking [Solution]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhAIi53IFkgR4uxrEBYPuB-F3q7Q62THtlkBfV2x-YiOICrmJ97VkHMIuPLrvaeG_olaR5J77w-7SHB73nR5sDU5sMMROvpCqAdNWTJ-QSEWaVbCfQLeH8UEnR6ZoXbomJkZfL9nRa6P14-/s16000/tvs_speed_40_plus_poupdates.jpg)

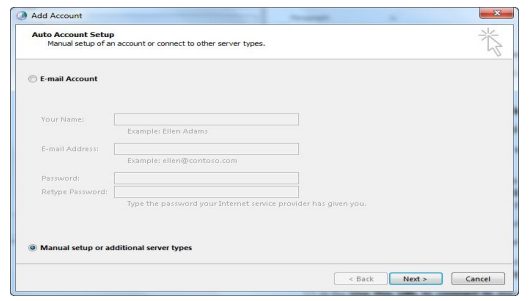

![How To Open IPPB Digital Savings Account Online? [in 5 Mins]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhlyMugHPU9UxHlDUmW5a0crz5qh_36xWNuJ5G_1TYtyuYeCbzLtKNFG5XWkPd9Cfqt9kzY5436wVHmYess_CVpBpg4Ap8imqI0FwJEGCOHBo0gvsg6qwx1Wut72p31QpaaxFi_hlblsAGC/w148-h320/Open-IPPB-Digital-Savings-Account-Online-step-1.jpeg)